But now I am retired and have three school age children. You don't get there by accident. We've blogged on how during our working years we spent most of our "spare time" earning additional income. We've blogged from time to time about our investments and investing strategy. During our productive working lives, instead of buying fancy cars, frequenting snazzy joints, or taking luxuriant vacations, there were years when we saved 30 to 40 percent of our income. Those savings went straightaway into retirement and non-retirement brokerage accounts to be traded and invested, as the case may be.

Now that we are retired things have changed. Our savings no longer come from income. We live day to day and month to month on our pension, supplemented by dividends paid out by stocks in our brokerage accounts. Our savings grow now only to the extent our investments grow.

Occasionally we have major expenses that require dipping into those investments. We are not yet pulling money out of retirement accounts (we hope to avoid doing so until Uncle Sam requires such starting at age 70 and one-half). This means when selling stock and withdrawing the proceeds, we consider tax implications, if for no other reason than to make quarterly estimated tax payments timely to the IRS and state tax authorities.

During my working days we liquidated a large block of stock once to put on a major home addition, about doubling the size of our house. We also traded stocks and derivatives frequently during the days and months leading up to the 2008 financial meltdown, shorted stocks during the meltdown, and put money back in the stock market in the meltdown aftermath, beginning with its recovery in March 2009. These purchases and sales resulted in myriad taxable transactions, and substantial income tax liabilities, which we duly reported to the IRS and promptly paid.

Last month I had to sell some stock, so I scoured our brokerage account records and tried to select for sale stocks that yielded the right amount of tax liability -- not too little but not too much.

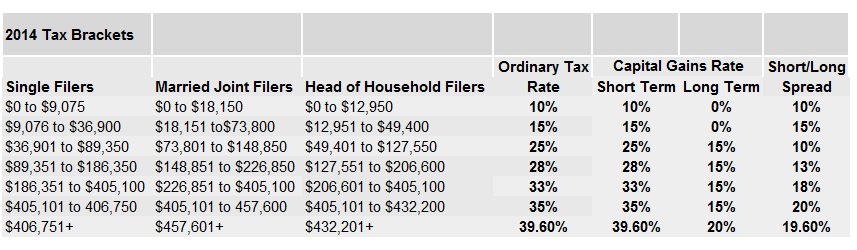

Then I thought, why the heck am I even thinking about this? Unless we win the lottery, when we do our 2014 taxes, once we take out the minimum standard deduction from our income and subtract our personal deductions, we will be down within the 15 percent ordinary income tax bracket, which means that all, or essentially all of our long term capital gains will be taxed at the resounding rate of 0 percent. That's right -- no tax, nada, nothing! Zero!

The 0 percent capital gains tax rate compares to, and graduates up to a rate of 23.8 percent (including the Medicare surcharge) for taxpayers earning $407,750 per year per year or more (filing as an individual) to $457,600 per year or more (married, filing jointly).

Here is a description of how the no-tax system works,

You may owe 0% on your investment profits

Despite the tax hikes included in the misnamed American Taxpayer Relief Act, long-term capital gains and qualified dividends earned in your taxable brokerage firm accounts are still taxed at 0% when they fall within the 10% and 15% federal rate brackets.

Many more people than you might think occupy these bottom two brackets. Remember: your bracket is determined by the amount of your taxable income, which equals adjusted gross income reduced by allowable personal and dependency exemptions and by the standard deduction amount (if you don’t itemize) or your total itemized deductions (if you do itemize).

|

| IRS Form 1040, Schedule D, Capital Gains and Losses |

Here are the story elements in tabular form.

- Say you are a married joint filer with two dependent kids. You claim the standard deduction for 2014. You could have up to $102,000 of adjusted gross income (including long-term capital gains and dividends from securities) and still be within the 15% rate bracket. Your taxable income would be $73,800, which is the top of the 15% bracket for joint filers in 2014.

- Say you use head of household filing status. You have two dependent kids and your claim the standard deduction for 2014. You could have up to $70,350 of adjusted gross income (including long-term capital gains and dividends) and still be within the 15% rate bracket. Your taxable income would be $49,400, which is the top of the 15% bracket for heads of households in 2014.

- Say you have no kids and claim the standard deduction for 2014. You could have up to $47,050 of adjusted gross income (including long-term capital gains and dividends and still be within the 15% rate bracket. Your taxable income would be $36,900, which is the top of the 15% bracket for singles in 2014.

To be perfectly clear, if your total taxable income, including long-term capital gains and qualified dividends, is less than the top of the 15% rate bracket, you will owe the Feds nothing for all your capital gains and dividends. If part of your gains and dividends fall within the 15% bracket and part of them fall outside, you will only owe 15% of the part that falls outside — unless your income is so high that the 20% maximum rate kicks in.

- If you itemize deductions, your 2014 adjusted gross income (including long-term capital gains and dividends) could be even higher, and your taxable income would still be within the 15% rate bracket.

The next time someone tells you the tax code burdens and discriminates against people on the bottom end, think about it. We are getting a free ride baby!

Your comments miss the only point that counts--The citizens of the United States of America are not paying in the revenue necessary to cover their expenses. As such, they are the most self indulgent group of people who have ever walked the face of this earth. We are all guilty.

ReplyDelete