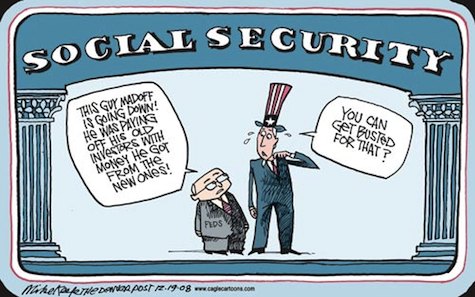

Despite what you may have heard, China isn't the country's biggest creditor. America is. The bulk of the national debt - soon to exceed a staggering $17 trillion - is held by the Federal Reserve, Social Security system, various pension plans for civil service workers and military personnel, U.S. banks, mutual funds, private pension plans, insurance companies and individual domestic investors.Now think about what the AP scribe has said -- the three biggest holders of U.S. government debt are the Federal Reserve (the U.S. government), the Social Security system (the U.S. government), and various pensions plans for civil service workers and military personnel (the U.S. government). How can the U.S. government owe the U.S. government? Are there trust funds set up where surpluses are deposited and segregated from other government assets? No. The AP story is telling us to find comfort from phony balancing entries in spreadsheets, a system Bernie Madoff would be proud of -- nothing else.

Think of it this way. You set up a fund for your children's education. You don't actually deposit money in that fund, but every month you increase the balance in that fund by the flick of a switch or an entry of a number. Your kid starts high school. She wants to know how her college education will be paid for. You say to your kid, "Don't worry, I am fully funding your college education." You say, "Young lady, look at these numbers, they are growing every month." What do you do when the kid says, "But Dad there is no real money there and you have spent your income on other things, what are you actually going to do when I start college? Tuition, room and board need to be paid with actual money -- not entries on spreadsheet." You could be honest, and say, "I don't know. I just created an artifice. It's a fraud. I'm sorry. I'll start fixing this right away." Or you could tell your daughter "Don't worry, that fund is backed up by my promise. I really, really want to pay. I'll figure it out somehow, even if ultimately you are the one who pays and we have to borrow from strangers who charge exorbitant interest rates. Don't worry it will work out, even though I won't tell you how." Then you could go to work for the U.S. government or write for the AP and sign up with the Democratic party.

Think of it this way. You set up a fund for your children's education. You don't actually deposit money in that fund, but every month you increase the balance in that fund by the flick of a switch or an entry of a number. Your kid starts high school. She wants to know how her college education will be paid for. You say to your kid, "Don't worry, I am fully funding your college education." You say, "Young lady, look at these numbers, they are growing every month." What do you do when the kid says, "But Dad there is no real money there and you have spent your income on other things, what are you actually going to do when I start college? Tuition, room and board need to be paid with actual money -- not entries on spreadsheet." You could be honest, and say, "I don't know. I just created an artifice. It's a fraud. I'm sorry. I'll start fixing this right away." Or you could tell your daughter "Don't worry, that fund is backed up by my promise. I really, really want to pay. I'll figure it out somehow, even if ultimately you are the one who pays and we have to borrow from strangers who charge exorbitant interest rates. Don't worry it will work out, even though I won't tell you how." Then you could go to work for the U.S. government or write for the AP and sign up with the Democratic party.The reality is every penny of the almost $7 trillion the government owing the government debt will eventually have to be funded by going out to the financial markets and asking, more like begging, the likes of China et. al. to pony up the resources. The burdens and repayment responsibility will be passed on to our children and grandchildren.

It so happens, the financial press came out later in the week with the following lead,

Foreigners now hold more than $13 trillion in American securities, a record set as the U.S. seeks to assert itself as the safest port in troubled global waters.

China and Japan combined owned more than $3.4 trillion, including $2.4 trillion in debt, a number that has grown since the data set was compiled.The total value of U.S. stocks and bonds under foreign ownership rose 6.5 percent in 2012, with stocks actually rising more on a percentage basis, according to the most recent data from the U.S. Treasury.

Foreign holdings have more than doubled since 2005 and are getting close to the $15 trillion total size of the U.S. economy.

|

| Outstanding U.S. Bond Debt, Source: http://www.freddiemac.com/investors/pdffiles/investor-presentation.pdf |

Also, the AP story only treats treasury debt as U.S. government debt when that is barely half of total marketable U.S. debt (i.e., the non-accounting gimmick stuff). Total U.S. debt includes agency debt as well the Freddie, Fannie, FHA and Ginnie Mae portions of Mortgage Backed Securities (MBS or what was known as CDO's during the financial crisis), totalling $10.3 trillion, compared to $10.9 trillion in marketable treasury securities referenced in the AP story. AP is off by half. How would you like to wake up some day and find your $250k mortgage was really a $500k? The AP would say, no problem because you can set up a fund to pay yourself. Don't worry, party on, borrow more. The AP has told me it is all Okay.

Your children and grandchildren will pay for the fraud and the excesses, more than you will ever know.

No comments:

Post a Comment